Washington State Salaries

Washington State Salaries

Washington State: Leading the Charge in the U.S. on Wage and Labor Policies. Recent changes to minimum wage levels, overtime exemptions, and special treatment in different fields of employment are all signs that the state is serious about providing appropriate compensation and protecting its workers. In this article, we take a closer look at the salary changes for 2023, what they mean for both employees and employers, and how the current salary landscape in Washington State has evolved over the years.

State Minimum Wage Increase

Washington minimum wage increases to $16.66 effective January 1, 2025, up 2.35% from the prior year This change is required under law, which directs the Washington State Department of Labor & Industries (L&I) to calculate the annual minimum wage based on the federal Bureau of Labor Statistics’ Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This increase in wages has been spurred by a rise in housing and food costs over the past year.

Employers are allowed to pay 85% of the adult minimum wage for workers 14-15, which is $14.16 per hour in 2025. It is also worth mentioning that Washington has one of the highest state-level minimum wage rates in the country, while the federal level is stuck at $7.25 per hour. Seattle, SeaTac, Tukwila, Renton, Bellingham, and Burien are just a few cities in the state that have enacted local minimum wages above the state minimum, shaped by the unique economic environments and cost of living in each locale.

Salary Thresholds and Overtime Exemptions

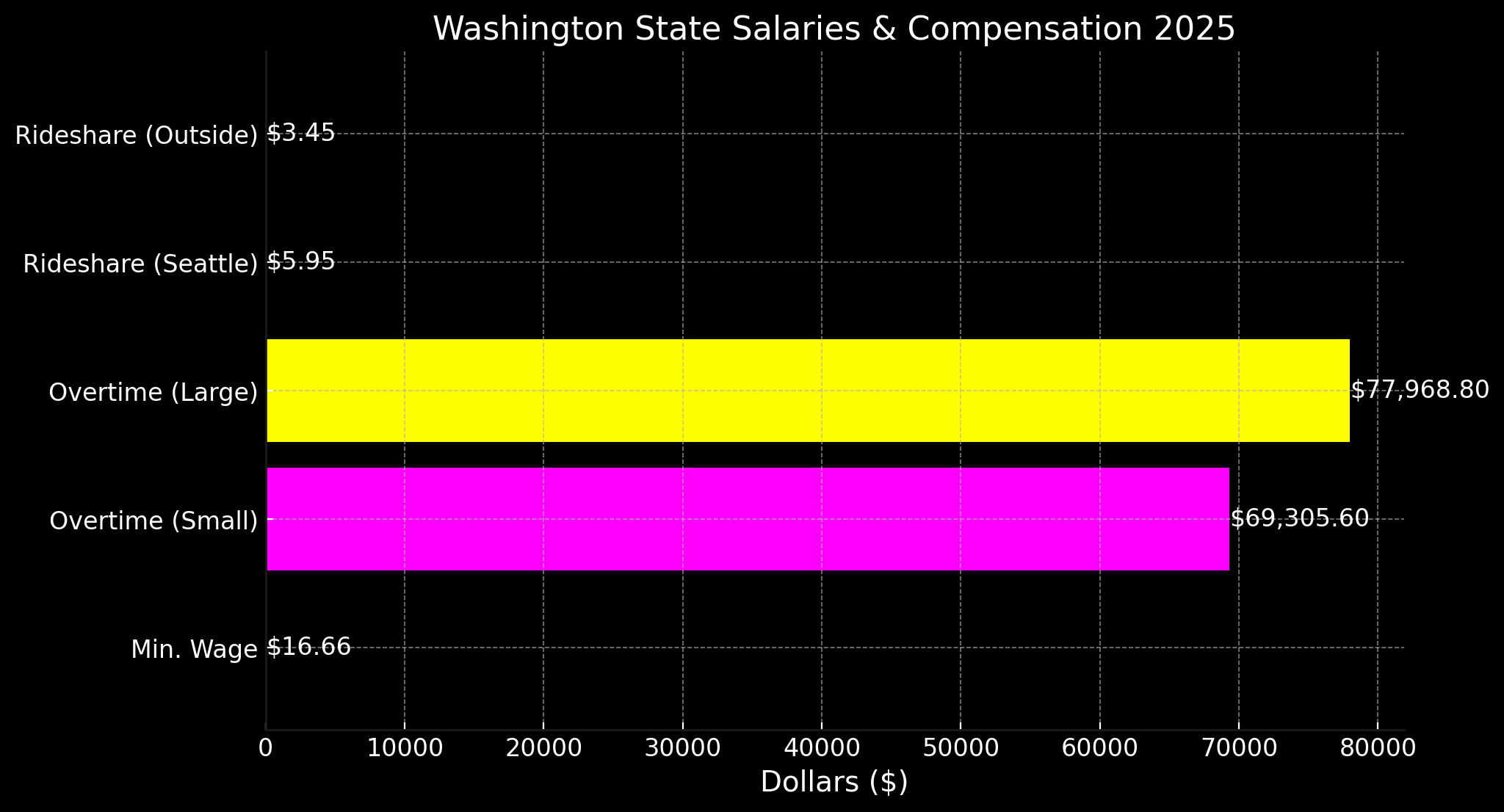

In 2023, Washington (WA) raised the minimum wage, effective 1 January 2023, and also updated the salary thresholds for exemptions from overtime. These thresholds are critical in determining whether executive, administrative and professional employees are exempt from overtime pay. The thresholds for 2025 are:

| Employer Size (Number of Employees) | Weekly Salary Threshold | Annual Salary Threshold |

|---|---|---|

| Up to 50 Employees | $1,332.80 | $69,305.60 |

| 51 or More Employees | $1,499.40 | $77,968.80 |

These numbers are multiples of the state minimum wage — 2 for smaller employers and 2.25 for larger employers. This gradual increase is part of an eight-year implementation plan, which began in 2020 to incrementally raise salary thresholds based on up to 2.5 times the minimum wage by 2028. The goal is to get salaried employees paid based on inflation and cost of living adjustments.

The hourly pay rate for overtime-exempt computer professionals will also be pegged at 3.5 times the minimum wage, translating to $58.31 per hour in 2025. This adjustment takes into account specialized skills and the current demand for tech professionals, reinforcing the demand for tech professionals to ensure wages align with their expertise.

Minimum Wage for Uber/Lyft drivers

The gig economy, and particularly rideshare services, has been a major force in Washington’s labor market. The state has enacted compensation standards specifically for rideshare drivers working for companies like Lyft and Uber, understanding the unique challenges that gig work presents. Beginning January 1, 2025 the minimum compensation rates are specified by the area of the trip:

| Trip Location | Per Minute Rate | Per Mile Rate | Minimum per Trip |

|---|---|---|---|

| Within Seattle | $0.68 | $1.59 | $5.95 |

| Outside Seattle | $0.39 | $1.34 | $3.45 |

From October 2023 onwards, these rates guarantee that drivers will receive just remuneration for the time and distance travelled you value the travel expenses and time spent 时间, money 和 属性, for delivering your car hardship. Note: These protections apply specifically to rideshare drivers, not food delivery workers, under this law.

Non-Compete Agreements

Washington has also reforms related to the enforceability of non-compete agreements, which are agreements that can severely limit employee mobility and career progression. Starting in 2025, to be valid, a non-compete must be applied to an employee who earns above a set salary threshold (currently, $105,000 annually):

| Worker Classification | Annual Earnings Threshold |

|---|---|

| Employees | $123,394.17 |

| Independent Contractors | $308,485.43 |

These thresholds aim to strike a balance between preventing lower and middle-income workers from being restrained by these covenants where they may not realistically affect future employment prospects, whilst enabling businesses to protect against legitimate competitive interests with respect to higher-earning employees and contractors.

Employer Incentive Programs

Its incentive programmes for employers to return and rehabilitate injured workers have also been improved in Washington. Effective January 1, 2025, the maximum wage reimbursements available to employers for the Stay at Work and Preferred Worker Programs will increase from $10,000 to $25,000 per claim. How they work: Financial rewards for employers who return an injured worker to gainful employment or assist them with returning to self-sustaining employment within their medical restrictions

Extended Passionate Illness Insurance Policy

Paid sick leave entitlements have also been expanded, to continued farmer welfare in Washington. Under the new law, which takes effect on January 1, 2025, employees may use paid sick leave to care for a much broader group of people, including any person who lives in the same residence; or any other individual with whom the employee has a close personal relationship in which the expectation of care during illness exists. Paid sick leave can also be used now when an emergency would result in an employee’s child’s school or daycare being closed, allowing workers more flexibility in dealing with personal and family health issues.